Time to clean up your accounting policies

Time to clean up your accounting policies

For-profit entities it's time to clean up your accounting policies

The purpose of the International Accounting Standards Board’s (IASB’s) Disclosure Initiative, which took effect in 2016, was to declutter and streamline financial statements. As part of this process, entities should have cleaned up their financial statements, including:

-

Presenting information in an orderly and logical manner

-

Placing notes in a meaningful order

-

Moving accounting policies to the relevant financial statement notes

-

Removing superfluous accounting policies.

In addition, there was a big push to remove ‘boilerplate’ technical language, and to replace it with plain English, meaningful explanations that could be easily understood by users of financial statements. While many entities devoted resources to this initiative back in 2016, we have seen ‘slippage’ by some, particularly with respect to the amount of accounting policy information disclosed, compounded by the three new accounting standards for revenue, financial instruments and leases, which became effective in 2018 and 2019.

| Changes to IAS 1 Presentation of Financial Statements, effective for annual periods beginning on or after 1 January 2023, require further streamlining of accounting policies in 31 December 2023 financial statements (and 30 June 2024 financial statements for 30 June reporting entities). |

What’s changed?

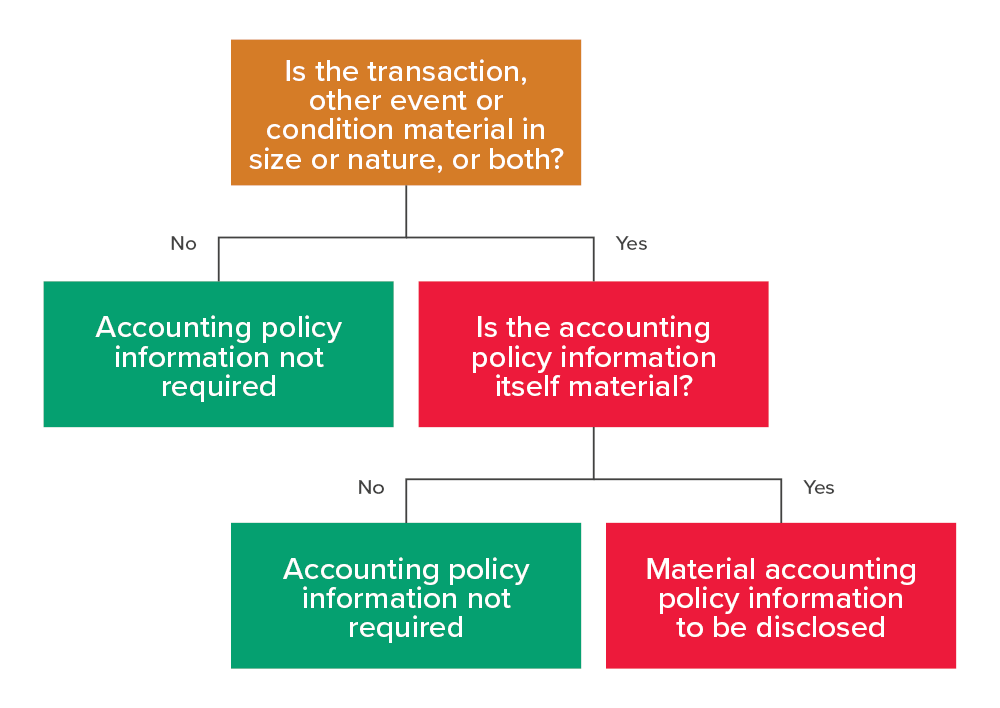

Only material accounting policy information should be disclosed.

Accounting policy disclosure is not required for:

- Immaterial transactions, other events or conditions (applying a quantitative and qualitative assessment)

- Material transactions, other events or conditions where the accounting policy information is not material.

When is accounting policy information expected to be material?

Accounting policy information is likely to be material if the information relates to material transactions, other events or conditions, and one of the following apply:- The entity chose the accounting policy from one or more options permitted under IFRS (e.g. measuring investment property at historical cost or fair value)

- The accounting policy was developed applying the hierarchy in IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors because no specific IFRS is dealing with the transaction

- The entity was required to make significant judgements or assumptions in applying the accounting policy, and these judgements or assumptions have been disclosed as required by IAS 1, paragraphs 122 or 125

- The accounting is complex, and users would otherwise not understand the material transaction (for example, if more than one IFRS standard applies to the transaction)

- The entity changed its accounting policy during the period, resulting in a material change to information reported in the financial statements.

No more ‘boilerplate’ accounting policies

Material accounting policy information focuses on how an entity has applied IFRS to its circumstances. Boilerplate accounting policies that merely duplicate or summarise accounting requirements of IFRS should be removed because they clutter up the financial statements and may sometimes obscure material accounting policy information.Examples of boilerplate accounting policies include items where there are no accounting policy choices involved, such as income taxes, foreign currency translation, cash and cash equivalents, property, plant and equipment (PPE), provisions for employee benefits, other provisions, current/non-current classification, etc. While there may be no choices in how to account for some of these items, there are judgements involved in their application, which needs to be disclosed. For example, when is revenue recognised, deferred tax assets recognised, development assets capitalised, etc?

So, while material accounting policy information may not be required to explain how items of PPE are capitalised, and how revaluation increments and decrements are recognised, an entity would still be required to explain for material balances of PPE:

- Whether PPE is subsequently measured at cost or revaluation

- Depreciation method chosen (straight-line versus reducing balance)

- Useful lives of PPE asset.

Remove superfluous accounting policies

Many entities currently disclose comprehensive accounting policy information for transactions and balances that they don’t have in the current year, or the prior year. Typical examples include:- Business combinations

- Accounting for foreign operations

- Financial liabilities measured at fair value through profit or loss

- Impairment

- Consolidation

- Non-current assets held for sale and discontinued operations.

These should all be deleted as they comprise immaterial accounting policy information and could obscure material accounting policy information.

How to get started?

We recommend entities avoid a last-minute rush and start work on streamlining accounting policies now.| Firstly, remove all accounting policies that are completely redundant because the entity had none of these related transactions or balances during the period. Then read each sentence of the remaining policies carefully. Working your way line by line, any information that comes straight out of an Accounting Standard can be deleted unless:

|

More information

Please refer to our previous article, Expect to see a reduction in the amount of accounting policy disclosures for more information.Need help?

Please contact BDO’s IFRS Advisory team if you require assistance with your accounting policy disclosure.

For more on the above, please contact your local BDO representative.

This article has been based on an article that originally appeared on BDO Australia: Read the original article here.